Debtor Turnover Days Formula

How do you calculate monthly debtor days. Accounts receivable also known as year end debtors 2.

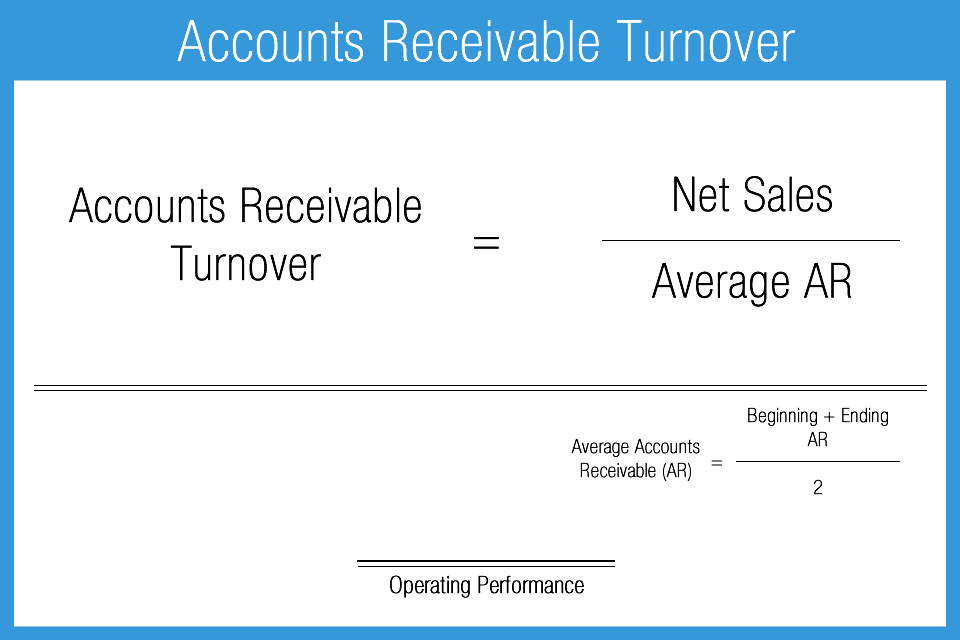

Accounts Receivable Turnover Ratio What You Need To Know Billtrust

Debtor Days Formula is used for calculating the average days required for receiving the payments from the customers against the invoices issued and it is calculated by dividing trade receivable.

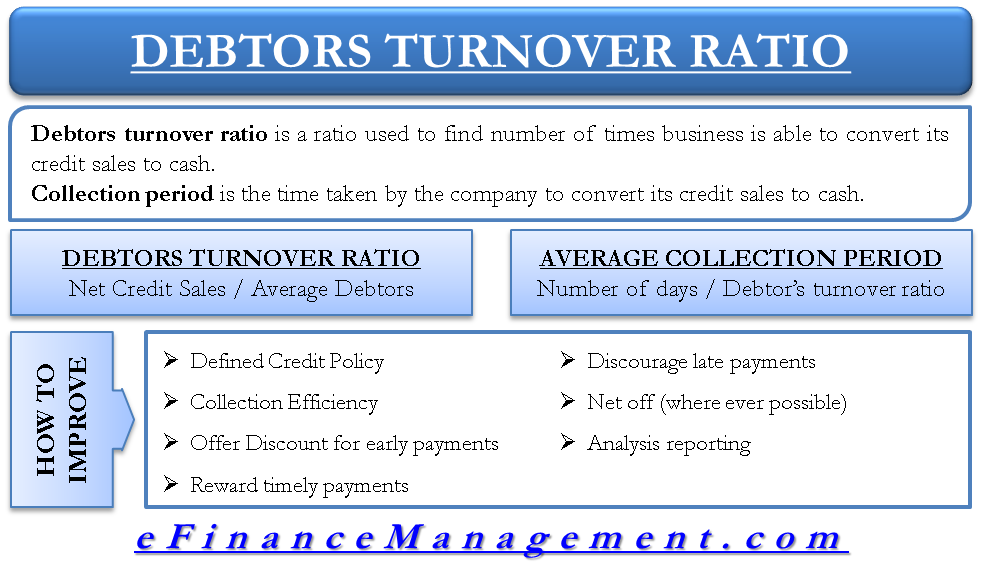

. You can calculate the CDR by applying the formula. Debtor Days accounts receivableannual credit sales 365 days. What is the debtors turnover ratio formula.

This is a question our experts keep getting from time to time. Now we have got the complete detailed explanation and answer for. Ad Tell Us about Your Situation and Get Step-by-Step Assistance for Your Unexpected Bills.

What youll need to calculate debtor days. How do you calculate monthly debtor days. Debtors or receivables turnover ratio analysis when calculated in terms of days is known as average.

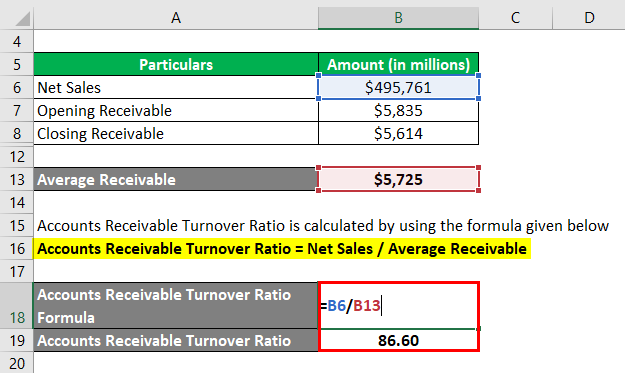

This is a question our experts keep getting from time to time. Debtor Days Formula is used for calculating the average days required for receiving the payments from the customers against the invoices issued and it is calculated by dividing trade receivable. Debtor Days Average Accounts Receivables Credit Sales 365 Days.

Formula for debtor turnover days. Take Some of the Stress Out of Unplanned Expenses with AARP Money Map. Accounts receivable is the amount of money owed to a company for.

Creditor Days Ratio Trade CreditorsCredit Purchases365. In the year end method you can calculate Debtor. Creditor Days Ratio or DPO Formula.

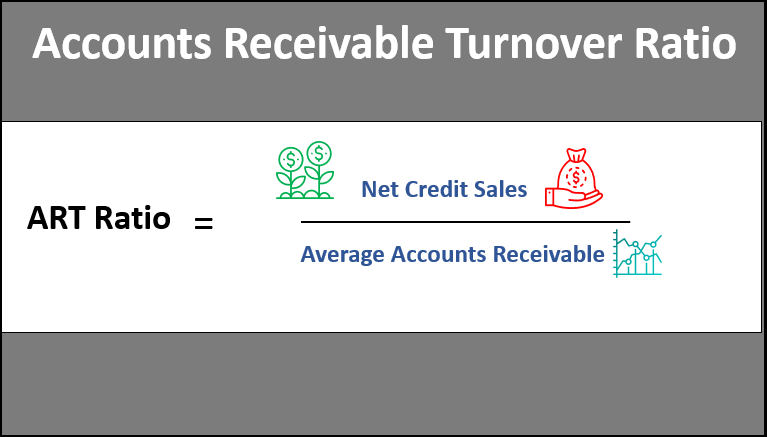

Using a companys credit sales results in a more accurate metric than using the total sales. The formula for the Year-End Method is as follows. There is more than one formula that you can use to calculate the debtor days.

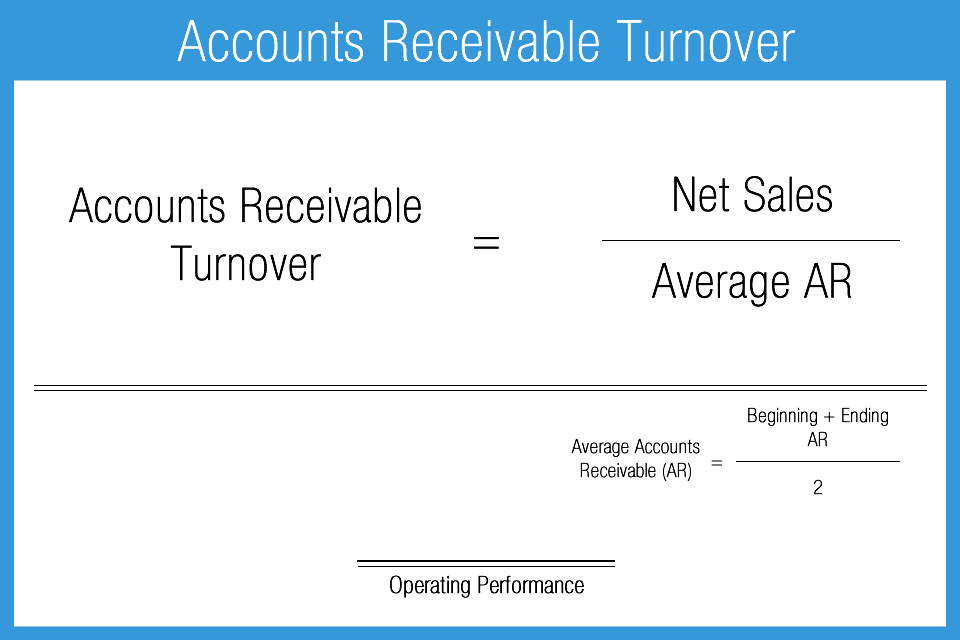

Average Collection Period 12 months or 52 weeks or 365 days Debtors Turnover Ratio. Higher the Debtors turnover ratio better is the credit management of the firm. Debtors turnover ratio formula indicates the velocity of debt collection of a firm.

Debtor Days Formula is used for calculating the average days. Debtor Days Formula is used for calculating the average days required for receiving the payments from the customers against the invoices issued and it is calculated by dividing trade receivable. To be more specific the first version of the debtor days calculates the debtor days ratio by.

Debtor Days Formula is used for calculating the average days. Now we have got the complete detailed. Formula for debtor turnover days.

From the above example the Debtors. Higher the Debtors turnover ratio better is the credit management of the firm. Ad Browse Discover Thousands of Book Titles for Less.

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template

How To Improve Receivable Turnover Ratio Collection Period

Accounts Receivable Turnover Ratio Top 3 Examples With Excel Template

Accounts Receivable Turnover Ratio Accounting Play

0 Response to "Debtor Turnover Days Formula"

Post a Comment